The Investment Pyramid For Asset Allocations

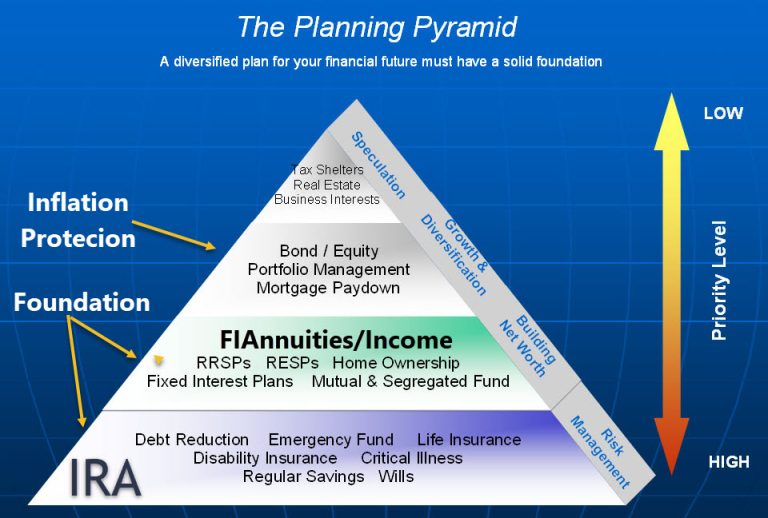

The idea of an investment pyramid is based on building the foundation (the bottom) the middle (some risk but higher reward) and the top (high risk and high reward).

The concept is simple, build your base and add the other portions as you work to gain your financial goals. That is the way the investment guys teach it, and for many, the concept has worked. For me I prefer a different look, I prefer to stay at the bottom and enjoy the no risk and lower reward investment options.

The foundation is built with no risk and lower yielding investment options such as US Treasuries, bank CDs, insurance annuities and other safe products. As the pyramid grows, more and more risk is assumed and with it should be assumed more yield.

Here is where I disagree with the pyramid, I want to stay with the safe and secure portion of the pyramid and to help offset the lower yield I will add options such as income guarantees.

By using the safe and secure portion combined with income options offered by annuities I can fulfill my financial objectives without the exposure to risk. Successful financial planning is really about income and how to maintain enough cash flow to overcome the future demands of life. By staying with safety, I can realize my goals without the added burden of risk.

Some available options can include Lifetime income, income for almost any time and income based on a specific amount per month. The investment pyramid can be a helpful tool when planning during your accumulation period, but there is always a point in all planning that staying in safety makes good sense.

Consider staying in the bottom of the foundation portion of the investment pyramid with your important retirement money.

Interested in a financial product that is immune to a faltering economy? Want to protect your savings and retirement funds?

Consider an annuity.