Zero-coupon bonds pay no interest; you buy at less than face value.

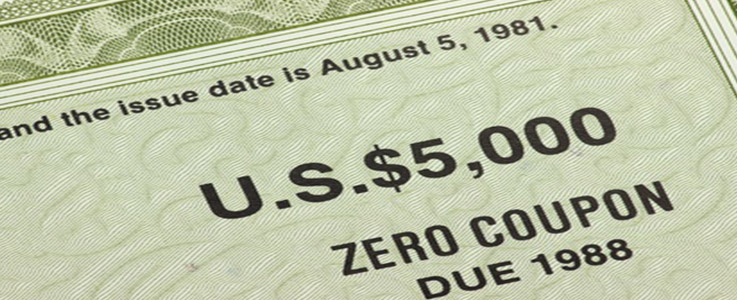

Zero-coupon bonds are bonds that do not pay interest during the life of the bonds. Zero-Coupon bonds are purchased at a discount, and they will fund the face value at maturity. A portion of the funds at maturity will be accumulated interest (the discount) and the original amount of the purchase price of the coupon. When a zero-coupon bond matures at maturity, the investor will receive one lump sum equal to the initial investment plus interest that has accrued.

Zero-coupon bonds have a duration equal to the bond’s time to maturity, making them sensitive to any changes in interest rates. In addition, investment banks or dealers may separate coupons from the principal of coupon bonds, known as the residue, so that different investors may receive the principal and each of the coupon payments. This creates a supply of new zero-coupon bonds.

The maturity dates on zero-coupon bonds can vary, and usually, the time period for these bonds is longer. Often these maturity periods may be 15, 20 years, or more. Investors can purchase zero-coupon bonds in the secondary markets that have been issued from various sources, including the U.S. Treasury, corporations, and state and local government entities.

Zero-coupon bonds pay no interest until maturity, but these are not necessarily deferred payments. The tax liability may still need to be paid annually because of the assumed yield, also known as the phantom tax. By using zero-coupon bonds issued by municipalities, the income tax can be avoided. Occasionally a for-profit corporation may issue a special tax-exempt zero-coupon bond that will not have annual tax liability tied to it.

The primary benefit of zero-coupon bonds to investors is that they can lock in current interest rates for the bond’s duration. Investors are attracted because they allow an investor to accumulate a fixed amount of money by a specified date, lock in the current interest rate until maturity, and have no call options risk in most bonds.

U.S. government zero-coupon bonds and corporate zero-coupon bonds are currently taxable as ordinary income to the investor even though the investor receives no current interest income from the bonds.

Another use for zero-coupon bonds is to use them as a basic investment in an IRA. Because they are placed in an IRA, the tax liability is deferred until the funds in the IRA are accessed. In addition, zero-coupon bonds provide long-term yields with a guaranteed locked-in interest rate.