“A solid credit score gives you more choices and the more choices you have, the greater the chance of retirement success.”- Steve Kerby

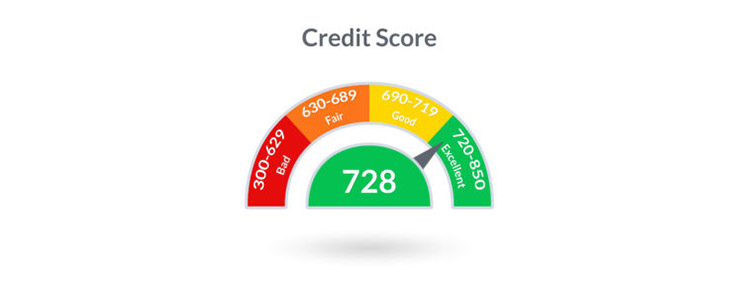

There’s a long checklist when preparing for the time when you no longer get a paycheck. People within 7-10 years of retirement have a lot on their minds. They may be dealing with potential cash shortfalls, health care concerns, aging parents, or tax issues, among other things. Because of these distractions, pre-retirees often don’t give their credit scores enough attention. However, if you want a less stressful, more prosperous retirement, you need to do everything possible to get (and keep) your credit score at 750 or above.

Even if you don’t plan to purchase much when you retire or decide to stay away from debt entirely, a strong credit score still matters for several reasons.

Credit scores can continue to impact many areas of your life, even when you’re retired. For example, if you still have a mortgage when you retire and rates drop, you may want to refinance. Or, you could decide to downsize and purchase a new home. An excellent credit score ensures you get the most favorable loans in both instances.

The act of retiring itself doesn’t show up on your credit report. Still, you don’t want to take your credit for granted. It is critical to keep your score intact, even if you are no longer working. You might want or need to purchase a new car or RV, switch credit card companies, or rent an apartment. Even your car and homeowners insurance premiums might be negatively affected if your score drops. With these things in mind, here are some things you can do to improve and maintain your excellent FICO score.

- Monitor your credit reports regularly. Some experts recommend using a credit monitoring service or setting up a calendar to check your credit every week. Many credit card issuers offer essential monitoring for their cardholders at no charge. Also, the law entitles you to a complimentary full credit report once a year. You can check three credit reports per year at www.annualcreditreport.com. Contact the reporting agency immediately if you find ANY wrong or incomplete information or see inquiries you do not recognize.

- Don’t close accounts. It’s tempting to want to close unused or paid-off credit card accounts. However, doing so may increase your debt-to-limit ratio, which is the relationship between a card balance and its’ credit limit. Closing a card can cause your utilization ratio to go up, affecting your score.

- Avoid co-signing loans. You want to help a loved one or friend qualify for a loan, establish credit, or get an apartment, so you agree to be a cosigner. However, taking on the role of a cosigner can backfire in a hurry. Many people do not realize that co-signing for a debt makes you equally liable for that debt, putting your credit on the line should something go wrong. Instead of co-signing, you could potentially add your friend or family member as an authorized user on one of your existing credit cards to help them build better credit.

- Aim for 100% on-time payments. Never be late, even if you experience cash flow issues, and only pay the minimum amounts due. Payment history makes up 35% or more of your FICO score calculation.

- Never “max out” your lines of credit. Creditors don’t like it when you are at, near, or over your maximum available credit. For example, if you have a card with a $2,500 limit and you have a $2,450 balance, the credit card company may categorize you as irresponsible and lower your score.

A rule of thumb is only to use around 10% of your credit limit. Your utilization percentage makes up nearly 30% of your FICO score.

These are just a few tips that could dramatically improve your credit score now and when you retire if you do them consistently. Remember, just because you no longer work doesn’t mean you can’t save thousands of dollars by using credit responsibly. Maintaining good credit will greatly improve your odds of having a less stressful, more enjoyable life after you stop working.